AlloyMtd eyes RM11bil Philippine ‘Putrajaya’ job

AlloyMtd Group has submitted a bid to build a new administrative centre for the Philippines Government at an estimated project development cost of $2.4 Billion US Dollars.

Located in the city of Clark, approximately 96 kilometres from Manila, the proposed 1,000-hectare Clark Administrative City project will house the executive, legislative and judicial bodies of the Philippines federal government.

It replicates Malaysia’s Putrajaya and will serve as the centralised site for the national government.

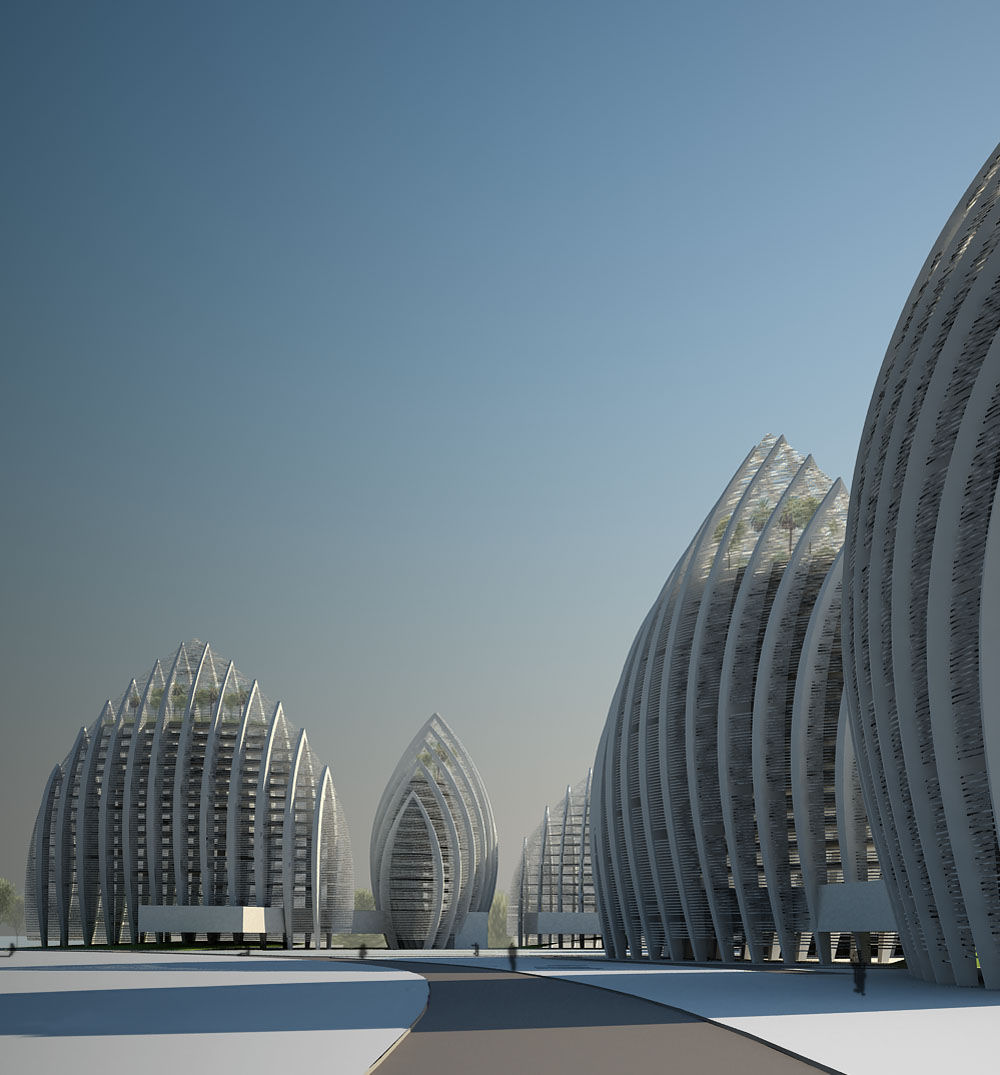

Under AlloyMtd’s proposal, the project will consist of 23 buildings encompassing some 273,000 square meters. The estimated project cost will be around US$2.4bil (RM10.62bil).

Speaking to reporters during the inauguration of the Palayan City Government Centre and Central Business Hub in Nueva Ecija province, AlloyMtd president and chief executive officer Tan Sri Azmil Khalid (pic) said the proposal represented a gigantic leap for the company, which has had a substantial presence in the Philippines over the past 11 years.

“We have had success in creating ‘mini Putrajayas’ in the country, or new centralised administrative and business centres to spur growth. But with a project of this magnitude, we can build a ‘real Putrajaya’ for the Philippines government,” he said.

The proposal to relocate and centralise the country’s Government entities has been mooted for a long time.

The consolidation of national Government offices away from the congested Metro Manila city centre will enhance efficiency, while at the same time the new location would also become a new centre of operations in times of natural disasters.

The project would be overseen by the Bases Conversion and Development Authority (BCDA), a Government agency created to manage the conversion of former military bases into income-generating facilities.

AlloyMtd was invited by the BCDA to submit the proposal for the development of the project. A presentation of the master development plan was made to the BCDA chairman and board executives on Feb 2.

Azmil added that funding for the project would likely come from a sukuk issuance in Malaysia.

“We are seeking the backing of the Philippines Government in regards to the sukuk so the terms are more favourable for investors,” he said.

International Trade and Industry Minister Datuk Seri Mustapa Mohamed, who was the guest of honour at the Palayan City project inauguration, lauded the proposal as it is wholly supportive of the Malaysian Government’s intention to boost economic and business relationships with its Filipino counterparts.

AlloyMtd has a track record in creating centralised business and administrative centres for local Governments in the country. Its projects include the Calabarzon Regional Government Centre and the ongoing Palayan City project, as well as the Bataan Government Centre.

The Malaysian conglomerate, which has a presence in 16 countries, has an entrenched presence in the Philippines in the infrastructure, institutional facilities and property development segments.

Building on the success of its RM1bil South Luzon Expressway project, the company is preparing for another major undertaking, as it had submitted an unsolicited bid for the Manila Mass Rapid Transit (MRT) Line 8 project last month.

The project, which was submitted by a consortium comprising AlloyMtd and East-West Rail Corp, spans about nine kilometres of elevated and depressed guideways with 11 stations along the route.

It runs from Quezon City to Lerma St. in Manila and the estimated project cost for the venture is around US$1bil (RM4.4bil).

The proposal is currently under review by the Philippines Department of Transportation and the National Economic and Development Authority (NEDA).

The MRT project is also the first project proposal from the private sector that was resubmitted to NEDA under the new Duterte administration, Azmil confirmed. - The Star Online