Double Dragon CEO Edgar "Injap" Sia

Philippines' Double Dragon aims to build new mall empire outside Manila

CLIFF VENZON, Nikkei staff writer

With the Philippines' consumption-driven economic boom showing no signs of abating, modern retail enterprises are sprouting up outside the capital. Some of the seeds are being planted by new companies eager to make a mark alongside the country's established conglomerates.

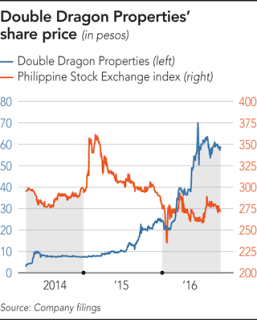

Double Dragon Properties is one of the up-and-comers. Back in April 2014, when its valuation was less than $100 million, the company listed on the Philippine Stock Exchange. In its maiden round of trading, the stock shot up by 50%, hitting the bourse's ceiling. Since then, it has continued to be a strong performer.

On Friday, the shares settled unchanged at 59 pesos, up 29-fold from the initial public offering price of 2 pesos. So far this year, Double Dragon's stock has surged 140%, making it the best-performing real estate company in the PSE's property subindex. The price has climbed in conjunction with the rise of Rodrigo Duterte, the country's first president from the southern island of Mindanao who came into power in June. He has promised to boost economic activity in rural areas.

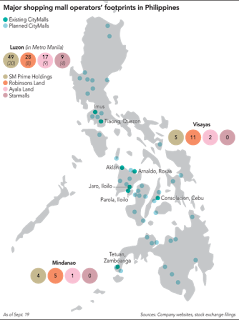

Double Dragon's priority is the construction of 100 shopping centers, each measuring 5,000 to 10,000 sq. meters, by 2020. As of June, the company had secured 53 sites for these CityMalls, as it calls them, but built only eight.

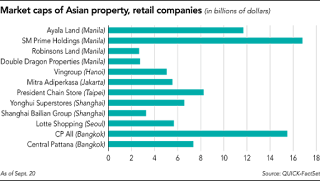

Yet, even if some of the projects are behind schedule, its market capitalization of 131.5 billion pesos ($2.75 billion) has eclipsed that of Robinsons Land -- a unit of conglomerate JG Summit Holdings that has built 44 large shopping complexes and dozens of residential and office developments nationwide.

Double Dragon is led by CEO Edgar "Injap" Sia, a 39-year-old businessman from Visayas in the central Philippines. The self-made entrepreneur is best known as the founder of Mang Inasal, a fast-food company that specializes in grilled chicken.

When Sia started his entrepreneurial journey about a decade ago, success was anything but a foregone conclusion. Born to a Chinese-Filipino-Japanese parents that own a grocery store in Roxas City in Visayas central Philippine region, Sia dropped out of college to focus on building his own businesses. In 2003, he opened a grilled chicken eatery in the parking lot of a mall in Iloilo City, also in Visayas. Its specialty, paired with unlimited rice, became a phenomenon, shaking up a fast-food market dominated by Western-style fried chicken.

In 2005, Sia established Mang Inasal for franchising, creating the nation's quickest-growing fast-food chain at the time.

An encounter with Tony Tan Caktiong -- the founder of Jollibee Foods, the Philippines' largest fast-food group -- proved to be a key turning point for Sia. The men, who share Chinese ethnicity, were both born in the Year of the Dragon in Chinese lunar calendar, albeit 24 years apart. The "two dragons" opened a dialogue about the future of Mang Inasal.

Sia's business was becoming a threat to Jollibee. Tan Caktiong offered to take control of the ascendant chain. In 2010, Sia agreed to sell Jollibee a 70% stake.

This past April, Sia unloaded the remaining 30% to Jollibee. Both transactions valued Mang Inasal at 5 billion pesos.

From Sia's perspective, selling to Jollibee made sense on two levels. First, it would put Mang Inasal under the control of an experienced fast-food company that would nurture -- rather than kill -- his brand. Second, despite his proven knack for entrepreneurship, he needed the money to pursue his second dream: building a property and retail empire.

"I really like the [real estate] business, but it needs substantial resources," Sia told the Nikkei Asian Review on Sept. 16.

Powerful backers

In late 2011, after Sia relinquished the management of Mang Inasal to Jollibee Foods, Tan Caktiong approached him again. The Jollibee boss, too, had been eyeing real estate. Sometime in 2012, the pair mapped out a plan to transform Injap Land, an Iloilo-based developer, into Double Dragon, a nationwide player.

"We want to become one of the largest property companies in the Philippines," Sia said.

While clearly ambitious, Sia is also pragmatic. Before the IPO, he accepted an offer from SM Investments -- the Philippines' largest conglomerate, owned by the Sy family -- to acquire a 34% stake in City Mall Commercial Centers, the entity that runs CityMalls under Double Dragon.

This gave Sia two powerful backers: Jollibee, a giant on the Asian fast-food scene; and SM Investments, which owns top Philippine lender BDO Unibank, mall developer SM Prime Holdings and retailer SM Retail.

All sides stand to benefit. Jollibee and SM Group see Double Dragon and CityMalls as vehicles to tap provincial markets. As the principal shareholders of each company, Jollibee and SM will be priority tenants in the CityMalls.

The malls are "barely in Luzon and mostly in Visayas [and] Mindanao, which are exactly the underpenetrated regions where we think we would like to grow," SM Group consultant Tim Daniels was quoted as saying in a local report in 2014.

Sia is avoiding Manila and broader Luzon, where more established players have secured land strategically. Instead, Double Dragon plans to open 70% of its branches in Visayas and Mindanao. To this end, he is taking advantage of know-how gleaned from the expansion of Mang Inasal: The fast-food chain now has about 450 locations, many in the same outlying areas where Sia intends to build CityMalls.

He sees Mang Inasal as a barometer of local readiness for a modern shopping experience. Like the chicken restaurants, CityMalls will be situated in places with large concentrations of people -- near transport terminals and markets, for example.

Right places, right time

Mang Inasal's grilled chicken took the Philippine fast-food market by storm.

In October, a CityMall is set to open in the Mindanao city of Cotabato. The city is located west of Davao -- the hometown of Duterte. Cotabato used to be a hot spot for terrorism and Muslim insurgents. "There are no SM or Robinsons malls there," Sia said, "but there has been Mang Inasal for eight years."

Sia is confident he has chosen the right target markets. "We strongly believe in the great potential of Visayas and Mindanao," he said. "I personally had a very good first-hand business experience ... in [the] Visayas and Mindanao areas during the expansion of Mang Inasal." He added that the chain had "over 150 stores in Visayas and Mindanao in operation for several years."

In 2015, Metro Manila's annual economic growth rate of 6.6% topped Luzon's 5.4%, Visayas' 5.8% and Mindanao's 5.3%. However, the Duterte government's agenda for achieving "inclusive growth" is expected brighten the prospects for rural regions. The president aims to preside over annual growth in the 7-8% range for the next six years, with provinces making a greater contribution than in the past.

Since the Metro Manila market is maturing, established retail players are also eyeing opportunities in the provinces. Their strategies vary. SM Retail is building its owns shops while tapping CityMalls to expand its network. Robinsons Retail Holdings and Puregold Price Club, the second- and third-largest players, are in a race to acquire provincial retailers with a couple of branches.

Meanwhile, around 70% of the Philippine retail sector remains informal, with myriad mom-and-pop shops. There are also independent provincial shopping center operators running scattered locations in first-tier cities. Of the 145 cities in the Philippines as of June 30, a third were so-called "first class" municipalities, meaning they have annual revenues exceeding 400 million pesos.

When it comes to creating a strategic network of shopping malls in the first-tier cities, Sia is considered to be a step ahead. He envisions CityMalls as one-stop shops for daily errands. He said he does not intend to compete with bigger malls, where customers stay the whole day on weekends, partaking in dining, shopping and entertainment.

"The transition from the traditional unbranded fast food to modern fast food [was] already done in the Philippine provinces a decade ago," Sia said. "The transition from traditional retail to modern retail in the provincial areas has just started, and is expected to be completed in the next few years." Sia wants to spearhead the new phase of retail industry through the expansion of CityMalls in the provinces

He continued: "That is the market where we are currently positioning CityMall, and once the transition cycle is done, CityMalls are poised to be the biggest beneficiary."

Still, while the stock market is cheering Sia's strategy of focusing on Visayas and Mindanao, Double Dragon does face its share of challenges.

Skeptical analysts

Some analysts argue the company is overvalued, partly because most of its investors are retail players, who tend to play up stocks. It was only in July last year that Double Dragon managed to attract long-term institutional investors, and it may need to do more to improve its credibility with bigger funds.

"The price is not warranted at this time," said Richard Laneda, an analyst at COL Financial in Manila.

The company's first-half net income rose 16% to 144 million pesos, as revenue jumped 15% to 706 million pesos. It is targeting net income of 4.8 billion pesos by 2020.

Double Dragon's price-earnings multiple is 100, higher than those of SM Prime and Ayala Land, which are both trading at around 30, noted Luis Limlingan, managing director of Reginal Capital Development.

Sia said analysts should look beyond that metric. "Clearly, our investors are not looking at the 'now,' they are looking at the next five-, 10- or maybe 15-year horizon."

Anton Alfonso, an analyst at RCBC Securities, cautioned that Visayas' and Mindanao's underdeveloped infrastructure could hamper Double Dragon's mall network buildup. Convenience store chains looking to expand there have faced similar challenges.

Despite some delays in branch openings, Sia said the company is confident it will meet its targets. "We should be able to announce the next phase of our business in the next few years," he said, adding that Double Dragon is open to overseas opportunities as well.

To be sure, Double Dragon has the Philippines' consumption-driven growth going for it. Consumption generates two-thirds of the country's gross domestic product, and projections indicate the economy should keep expanding by an average of over 6% for the next six years on the back of steady remittances from overseas Filipino workers and growing business process outsourcing industry.

Sia is hardly the only new-generation executive looking to make hay. Steve Benitez, from the central Philippine island of Cebu, aspires to turn his Bo's Coffee chain into the world's next Starbucks; it currently has 60 domestic branches. Ben Chan, another self-made entrepreneur, is building an apparel company, Bench, and is taking it into other Southeast Asian countries and China.

Then there are the heirs who are taking the reins of their family businesses. In 2015, Puregold Price Club appointed the son of founder Lucio Co, Ferdinand Vincent, as CEO. Puregold's parent company, Cosco Capital, plans to compete with Sia in the community mall segment.

Sia believes the completion of the 100 CityMalls is just the beginning of his new empire -- and a rock-solid foundation. "Once we complete that, our presence will be powerful, and the confidence in our company will be higher."

In Southeast Asia huge family businesses, conglomerates and state-owned companies are still widely seen to dominate the economies. While Sia's accomplishment of his ambitions remains to be seen, success of new-generation entrepreneurs will be the key to bring the region to the next stage of growth.

Source: – Nikkei Asian Review